Frequently asked questions

Check out the resources below to help you navigate the world of business, tax and short-term rentals.

General

As a QuickBooks pro-advisor, Wingr has access to discounted rates on QuickBooks subscriptions, which we are more than happy to pass onto our clients. Please reach out and let us know if you would like further info.

Once we’ve confirmed the cost and other details with you, if you would like to proceed you can transfer the billing to us by following these steps…

- sign in to QuickBooks

- click on the Gear Icon in the top right corner

- select ‘Subscriptions and billing’

- click on the ‘Allow billing transfer to your accountant?’ link

- You should be able to select Wingr, then click ‘Allow transfer’

Once you authorise the transfer, please let us know at hello@wingr.com.au as we need to finalise the changeover at our end within 2 days 😊

Sometimes we need to have a copy of your bank transactions in CSV format. This allows us to upload missing transactions into your accounting software in bulk and eliminates a lot of manual data entry.

If you have a Commonwealth Bank account, you can use these instructions to export the transactions:

- Log on to NetBank

- Choose the account you want to export transactions from

- Click on the dropdown box labelled ‘Date’ next to the search box and enter the required time period (this is usually limited to the last 2 years)

- Hit Export

- Select the CSV format and hit Export

Note: You can search / export up to 600 transactions going back a maximum of 2 years.

To approve the automatic super payment in Xero, you will need to…

- log into your Xero file

- go to Payroll and select Superannuation

- click on the batch that says ‘Pending Approval’

- review the list of payments and make sure everything looks good, then click ‘Approve’

- enter your authorisation code (this will be sent to your mobile) but there should be an option to request a new code if you don’t have it.

- click ‘Approve & Submit’

- if prompted, confirm the bank account for payment

Let us know if you have any issues with the approval as soon as possible so it doesn’t delay your super payments.

It is possible to transfer a business name from one ABN to another. This might be needed if you are changing business structures or if you sold your business and the name is part of the transfer. There are two sides to this process as follows:

If you currently own the business name and want to transfer to another ABN, you will need to follow these steps…

-

Step 1: Check Eligibility for Transfer

Before transferring a business name, ensure:

- The business name is currently registered.

- The business name is not expired. If it has expired, you’ll need to renew it before transferring.

- The business name owner (seller) is authorized to make the transfer.

Step 2: Request an ASIC Business Name Transfer Number

The current owner (seller) must:

- Log in to ASIC Connect

- Visit the ASIC Connect website and log in to your account.

- If you don’t have an account, you’ll need to create one.

- Request a Transfer Number

- Select ‘Lodge a transaction’ > ‘Cancel/Transfer Business Name’.

- Choose ‘Transfer Business Name’ and follow the prompts.

- ASIC will provide a business name transfer number (valid for 4 months).

- Provide the Transfer Number to the New Owner

- The seller must give this transfer number to the buyer.

- Do not cancel the business name registration—the new owner will complete the transfer process.

Step 3: Buyer Registers the Business Name

The new owner (buyer) must:

- Log in to ASIC Connect

- Go to ASIC Connect and log in.

- Start a Business Name Registration

- Click ‘Register a Business Name’.

- Enter the business name transfer number received from the seller.

- Complete the application by providing:

- ABN (Australian Business Number)

- Business name details

- Business address

- Contact details

- Pay the Registration Fee

- ASIC charges:

- $42 for 1 year

- $98 for 3 years

- Payments can be made by credit card, BPAY, or EFT.

- ASIC charges:

Step 4: Wait for ASIC Approval

- ASIC typically processes applications within 2–3 business days.

- You’ll receive a confirmation email once the transfer is approved.

Step 5: Update Business Records

After the transfer is complete:

- The previous owner should remove the business name from their records.

- The new owner should update details with:

- ATO (for tax purposes)

- ABN details (via the Australian Business Register)

- Banks, suppliers, and clients

Important Notes

- The transfer number expires after 4 months if not used.

- If the business has outstanding fees, debts, or compliance issues, ASIC may reject the transfer.

- The new owner should check that the business name is not trademarked separately through IP Australia.

Yes, the Australian Taxation Office (ATO) requires you to keep records for any expenses you claim as a tax deduction. Generally, you must have a valid receipt or other proof of purchase that includes:

✔ The name of the supplier

✔ The amount of the expense

✔ The date of the purchase

✔ A description of the goods or services

✔ The payment method used

If you don’t have a receipt, you may still be able to claim a deduction if you have alternative evidence, such as bank statements, invoices, or logbooks (for work-related travel). However, the ATO may disallow deductions if you cannot substantiate them with proper records.

Can I pay cash?

Paying cash is not an issue, but you will need to have a receipt or tax invoice to substantiate the deduction should the ATO request one. In some cases bank statements can be used as noted above, however a cash withdrawal is unlikely to have sufficient information on the transaction itself without a written receipt or other documentation.

How long do I need to keep receipts?

You must keep records for at least five years from the date you lodge your tax return. If you claim deductions for assets like equipment or vehicles, you may need to keep records for longer to show depreciation or capital expenses.

Section 1 - Getting Started with Wingr

To give us access to your QuickBooks file, follow these steps…

- sign in to QuickBooks

- click on the Gear Icon in the top right corner

- select ‘Manage users’

- click on ‘Accounting firms’

- enter our details as follows:

- Email address: emma@wingr.com.au

- click ‘Invite’

As a QuickBooks pro-advisor, Wingr has access to discounted rates on QuickBooks subscriptions, which we are more than happy to pass onto our clients. Please reach out and let us know if you would like further info.

Once we’ve confirmed the cost and other details with you, if you would like to proceed you can transfer the billing to us by following these steps…

- sign in to QuickBooks

- click on the Gear Icon in the top right corner

- select ‘Subscriptions and billing’

- click on the ‘Allow billing transfer to your accountant?’ link

- You should be able to select Wingr, then click ‘Allow transfer’

Once you authorise the transfer, please let us know at hello@wingr.com.au as we need to finalise the changeover at our end within 2 days 😊

To give us access to your Xero file, follow these steps…

- sign into Xero

- click on your organisation/business name on the top left of the screen

- click on ‘Settings’

- select ‘Users’

- click on ‘Invite a User’

- enter our details as follows:

- First name: Jason

- Last name: Gillespie

- Email address: hello@wingr.com.au

- at a minimum we will need Advisor level access as well as the following features…

- manage user access

- payroll (if you’re using it)

- add a message (totally optional)

- click ‘Send Invite’

To update a user’s access in Xero, you can follow these steps…

- sign into Xero

- click on your organisation/business name on the top left of the screen

- click on ‘Settings’

- select ‘Users’

- click on the name of the user you want to update

- in the change permissions section, please tick the boxes for:

- ‘Manage users’ and

- ‘Payroll admin’ (if you are processing payroll)

- click update permissions to finalise the changes

These access levels are required to ensure our whole team can log into your file to perform our services. And although we may not be processing payroll on your behalf, having access to your payroll information allows us to more easily view these details to ensure that the payroll information reconciles correctly in your accounts.

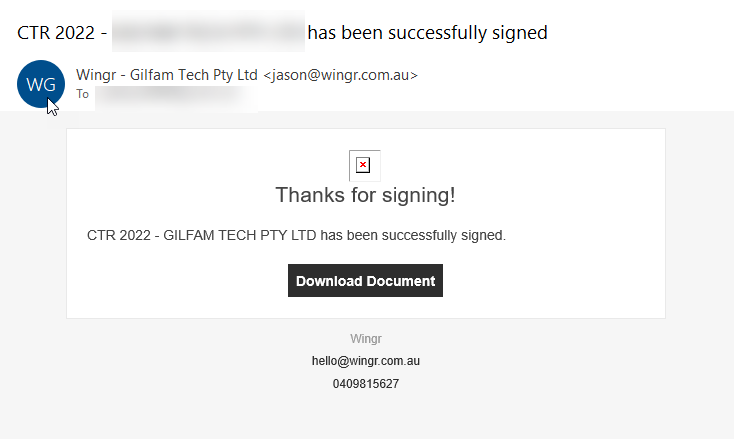

Every time you sign a business activity statement or tax return you will receive a follow up email thanking you for signing. This email also includes a link to download a copy of the document for your records. We recommend you download a copy of all your lodgements as you go, so you’ve got them when you need them. However, these links generally do not expire so if you need to find copies of old documents that you don’t have (eg for applying for a loan), simply search your inbox and click on the links to download.

**If you’re having trouble finding it in your inbox, try searching for “LodgeIt” or “has been successfully signed” to narrow it down.

Instructions for Download

- Open the email and click on “Download Document”

- Tick the box to confirm “I’m not a robot”

- Check the last 2 digits displayed match your mobile number, and click “Send Code”

- Enter the code into the box and click on “Verify”

- Click on “Download”

Sometimes we need to have a copy of your bank transactions in CSV format. This allows us to upload missing transactions into your accounting software in bulk and eliminates a lot of manual data entry.

If you have a Commonwealth Bank account, you can use these instructions to export the transactions:

- Log on to NetBank

- Choose the account you want to export transactions from

- Click on the dropdown box labelled ‘Date’ next to the search box and enter the required time period (this is usually limited to the last 2 years)

- Hit Export

- Select the CSV format and hit Export

Note: You can search / export up to 600 transactions going back a maximum of 2 years.

To appoint Wingr to act as you Registered Agent with ASIC, you just need to fill out this online Form 362 Nominate or Cease a Registered Agent.

When it comes to appointing us to act as your tax or BAS agent for another entity (other than yourself) then we need you to do a nomination to the ATO first. Only authorised contacts can add the nomination and you can find detailed instructions on the ATO website here: https://www.ato.gov.au/agentnomination.

You can also download a pdf version with the step-by-step instructions here: How to Nominate an Agent in ATO Online Services for Business

Section 2 - Navigating the ATO

When you appoint Wingr as your Tax Agent, it allows us to act on your behalf with the Australian Tax Office (ATO). It authorises us to access your information, contact the ATO on your behalf and lodge your returns. It also allows us to provide you with personalised tax advice relevant to your situation.

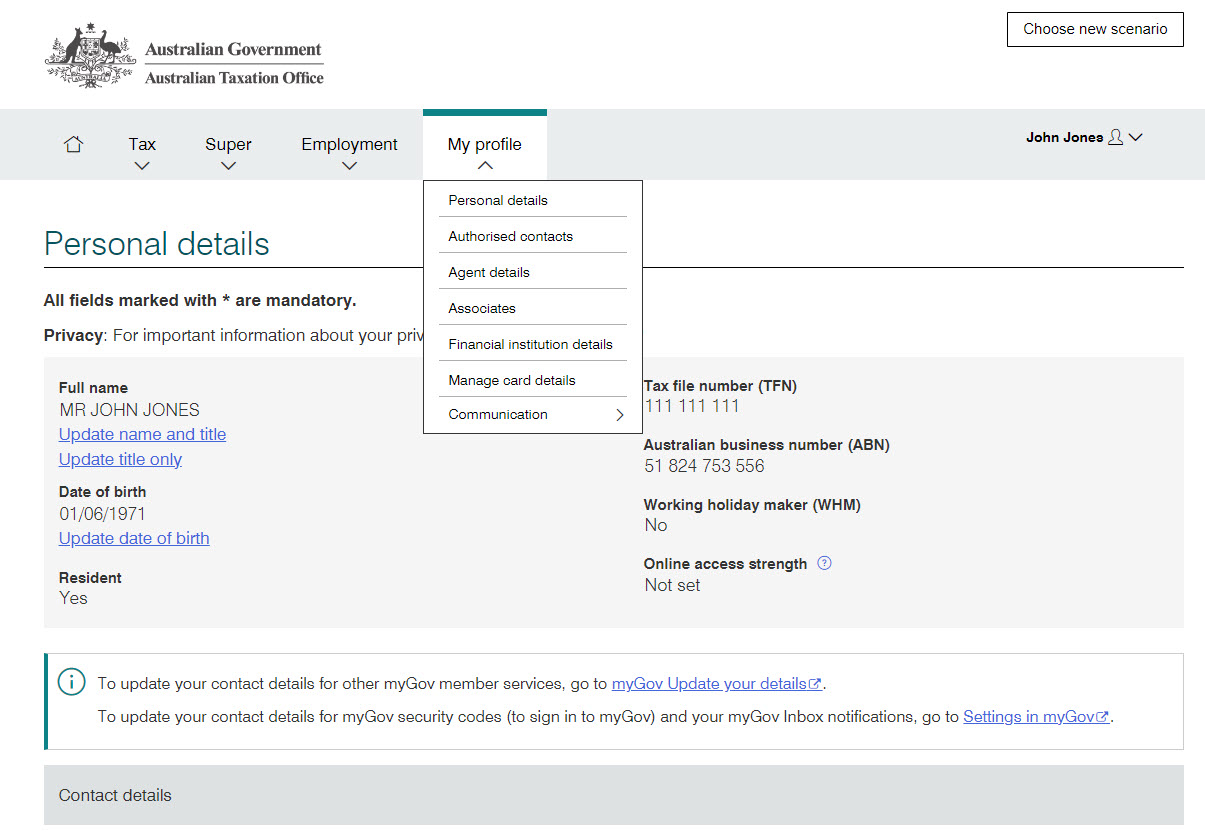

You can update your personal details with the ATO by logging into ATO Online Services.

STEP 1:

- sign into my.gov.au

- select ‘Australian Tax Office’

STEP 2:

- click on ‘My profile’

- select ‘Personal details’

STEP 3:

- check and update your address, phone or email details as needed.

If you’re not a sole trader and need to update your business’ details (eg company/trust), you will need to log into ATO Online Services for Business – see here for detailed instructions.

To update your business’ details (partnerships, trusts, companies, SMSF’s) with the ATO, you will need to log into ATO Online Services for Business…

STEP 1:

- sign into onlineservices.ato.gov.au/business/

- click ‘Login’

- sign in using your myGovID

- click on your business/entity name

STEP 2:

- click on ‘Profile’

- select ‘Business details’ and update as needed

- select ‘Business addresses’ or ‘Email addresses’ and update as required

While you are logged in, you may wish to check other details such as authorised contacts and financial institution details to make sure everything is up to date.

If you are a sole trader or individual, you can find details of your past lodgements with the ATO by logging into myGov…

STEP 1:

- sign into my.gov.au

- select ‘Australian Tax Office’

STEP 2:

- click on ‘Tax’

- select ‘Lodgments’

- depending on what you are looking for, select ‘Activity Statements’ or ‘Income Tax’ or a range of other lodgement types.

STEP 3:

- click on the ‘History’ tab for lodged returns.

To find copies of your past business lodgements with the ATO, you will need to log into ATO Online Services for Business using your myGovID as follows…

STEP 1:

- sign into onlineservices.ato.gov.au/business/

- click ‘Login’

- sign in using your myGovID

- click on your business/entity name

STEP 2:

- click on ‘Lodgments’

- depending on what you are looking for, select ‘Activity Statements’ or ‘Income Tax’ or other lodgements as required

STEP 2:

- click on the ‘History’ tab for lodged returns

STEP 1:

- sign into my.gov.au

- select ‘Australian Tax Office’

STEP 2:

- click on ‘Tax’

- select ‘Payments’

- select ‘Payment’

STEP 3:

- click on ‘Credit/Debit card’ or

- select ‘BPAY’

Depending on which option you choose, further payment details will appear.

STEP 1:

- sign into onlineservices.ato.gov.au/business/

- click ‘Login’

- sign in using your myGovID

- click on your business/entity name

STEP 2:

- click on ‘Accounts and Payments’

- select ‘Payments’

STEP 3:

- click on ‘Credit/Debit card’ or

- select ‘BPAY’ or

- select ‘Other payment methods’

Depending on which option you choose, further payment details will appear.

The ATO may impose “Failure to Lodge” (FTL) penalties if you’re supposed to lodge a return but don’t do it by the due date. This can apply to a whole range of lodgements such as activity statements, tax returns, PAYG Withholding returns, TPAR and more.

When cashflow is tight, we often find business owners avoid lodging their return so they don’t end up with a bill. But it’s important to remember that if you owe money to the ATO and lodge after the due date, they will usually apply the interest penalties from the original due date anyway – not the date of lodgement. So, even if you can’t pay by the due date, we still recommend you lodge on time to at least avoid the FTL penalties.

Business Activity Statements can be lodged annually, quarterly or monthly depending on your business’ turnover.

- Annually – if your business’ GST turnover is less than $75,000 a year and you are voluntarily registered for GST, then you can opt to lodge your BAS annually.

- Quarterly – if your business’ GST turnover is over $75,000 but less than $20 million a year, then you will report quarterly.

- Monthly – if your business’ GST turnover is over $20 million a year, or the ATO has advised you must report monthly.

There are a range of things that might be reported on your Business Activity Statement, including:

- GST – this includes GST you have collected as well as GST you have paid;

- PAYG Withholding – this is tax you have withheld from your employees or contractors or amounts withheld from suppliers who don’t provide their ABN;

- PAYG Instalments – this is a regular pre-payment of income tax and the ATO will let you know when you need to start making these payments;

- Fringe Benefits Tax instalments – this is for businesses who are registered and provide fringe benefits to their employees;

- Luxury Car Tax – this is limited to businesses that sell or import luxury cars or individuals that import luxury cars;

- Wine Equalisation Tax – this is limited to businesses that make or import wine or sell it wholesale.

You should check your Tax Registrations if you’re not sure what you need to report.

If you don’t pay the full amount owing on your BAS by the due date, the ATO will charge you interest on any unpaid amounts. This can add up pretty quickly and you end up losing more money out of your pocket than necessary.

Planning ahead and putting money aside is going to be the best way to ensure you can make the payments on time. This means routinely putting a portion of your income aside to cover the GST (this is often a rough estimate of say 5-7% of your income), as well as putting aside any PAYG Withholding amounts being processed via payroll.

The ATO determines the due date for your tax return based on a number of factors, including:

- are you completing your own tax return;

- have you appointed a tax agent to complete your return prior to 31 October;

- did you lodge your previous years’ tax returns on time;

- are you a larger organisation that owed tax in the previous year;

- what type of entity is lodging (company, trust, partnership etc);

You can log into the ATO online services to see what lodgements you have outstanding and what the lodgement due date is. Keep in mind, the very latest you can lodge most returns is 15th May (so 10-11 months after the end of the financial year) but you must do this through a Tax Agent.

When do I have to pay my tax?

The due date for the payment of your tax can vary so the best way to know for sure is to log into the ATO Online Services and it will show you any amounts payable as well as the due dates. To log in, see

PAYG Withholding for Employees

If you are an employee, your employer is required to deduct tax from your gross pay and pay this to the ATO on your behalf. This is called PAYG Withholding or Pay-As-You-Go Withholding.

It is taken out of your pay each pay period and is used to offset the total amount of tax you owe when you lodge your tax return. The amount of tax that your employer takes out is determined by the ATO calculators and cannot be varied unless you have an approved withholding variation in place.

PAYG Withholding for Employers

As an employer, each time you process a pay run (for yourself or for other external employees) your payroll system will tell you how much tax to withhold. This amount then gets reported and paid to the ATO on your Business Activity Statement (BAS) or Instalment Activity Statement if you’re not registered for GST.

Depending on how much PAYG Withholding you process will determine how often you need to report it and pay to the ATO – less than $25,000 a year is reported quarterly or $25,000 – $1,000,000 is reported monthly.

If you’ve received a notice from the ATO that you are now registered for PAYG Instalments, you might be wondering what that means.

Firstly, it’s good to note that PAYG Instalments are not an extra tax that you have to pay. Think of it like a pre-payment of tax to help you avoid a giant tax bill when you lodge your return at the end of the year. It’s kind of like paying off your new mobile phone in monthly instalments rather than having a big financial hit all at one.

Why have you been registered? Usually you will be registered for PAYG Instalments after you lodge a tax return that resulted in a tax bill. Essentially, the ATO wants you to avoid having a similar situation again this year so they’ll ask you to start paying some of the income tax in advance so it’s not such a big chunk all at once.

How much do you have to pay? The ATO will tell you how much the instalment is, which is usually an estimate based on how much tax you paid on the last tax return. If your situation is different this year and you’re not earning as much then you can vary the instalment to make it lower. Just make sure you don’t vary your instalment down and then end up having a tax bill….the ATO will think you were just trying to avoid paying tax and can penalise you.

How do you pay? If you’re already registered for GST, you’ll pay the instalment on your quarterly Business Activity Statement (BAS). It will be an additional section on the BAS. If you’re not already lodging a BAS, then you will be issued an Instalment Activity Statement (IAS) to pay the instalment each quarter.

What are the benefits? We like to think of PAYG Instalments as a good thing for you and your business because…

- you can avoid big tax bills at the end of the year,

- you can better manage your cashflow with predictable, regular payments,

- if you overpay you get a refund with your tax return,

- you can basically put your tax payments on auto-pilot and not have to stress all year about what you might owe at the end of the year.

Your Notice of Assessment (NoA) is basically a summary of your tax return after it’s been lodged. It shows:

- your taxable income,

- the amount of tax you need to pay based on your taxable income,

- the amount of tax you’ve already paid (if any), and

- the net amount payable or refundable after your tax return has been processed.

If you’ve paid more tax than you needed to, it will show a net refund amount. If you haven’t paid enough tax through the year, it will show the additional amount of tax payable.

NoA’s are only issued to individuals – companies, trusts and other structures don’t get issued one. And Wingr doesn’t get sent a copy of your NoA either – the ATO makes it available to you electronically.

If you’re looking for your current (or past) NoA’s, you can find them in ATO Online Services. You can access this via the myGov app, or my.gov.au.

The ATO will generally send you a text message once your return has been processed to confirm your NoA is available online. If you haven’t received these notifications, you may need to check that you have notifications turned on and/or make sure your mobile number is correct.

STSL debts are interest free loans. So unlike credit cards or other loans you don’t get charged interest on the balance every month. However, the total amount of your STSL debt is indexed every year on 1 June to maintain the balance of the loan in today’s real value.

Without going into too much detail, this simply means that in line with the rising costs of other products and services (also known as the CPI or Consumer Price Index) the real value of the loan amount also needs to increase over time. Just keep in mind that although the balance of your loan is going to increase each year, the amount you have to repay is calculated on your taxable income for the year.

As the balance increases, it will most likely mean it will take you longer to repay the loan balance so repaying more than the minimum amount will help to pay off this debt sooner and help avoid the impact of indexation.

Once you reach a certain income level, you are required to start making repayments towards your STSL debts. Each year, the ATO will publish the updated income thresholds as well as the repayment percentages so you should check their website for the current details.

Keep in mind that the repayment amount is not determined by the size of your debt, but is based on your taxable income.

If you have an STSL debt you should notify your employer via the Tax File Number (TFN) Declaration form. Your employer will then deduct an amount from your pay to help cover your STSL repayment according to the ATO withholding tables.

Keep in mind, this is not an exact science as the actual repayment amount cannot be determined until after you lodge your tax return. The amounts being withheld from your wages are not physically repaid against your STSL debt until your income tax return is lodged. It is essentially just additional tax being held by the ATO to put towards both your income tax obligations and any potential STSL repayment.

Once you lodge your tax return, the ATO will then look at your total taxable income as well as other factors to determine whether you meet the threshold to make a repayment towards your STSL debt, and if so, how much the repayment will be.

If your actual repayment amount is less than the amounts that have been withheld then you will receive a refund. If you haven’t had enough withheld from your wages then you will have to pay more to cover the repayment amount.

The Medicare Levy is an amount you pay in addition to the tax you pay on your taxable income. The current rate is 2% of your total taxable income. Generally, when your employer deducts PAYG Withholding from your wages it includes an amount to cover the Medicare levy.

Depending on your circumstances, you may be eligible for a reduction or exemption from the Medicare levy – find out more using the links below:

- Medicare levy reduction – https://www.ato.gov.au/individuals-and-families/medicare-and-private-health-insurance/medicare-levy/medicare-levy-reduction

- Medicare levy exemptions – https://www.ato.gov.au/individuals-and-families/medicare-and-private-health-insurance/medicare-levy/medicare-levy-exemption

This is different to Medicare levy surcharge, which is an additional levy that can also apply if your taxable income is above the threshold and you don’t have an appropriate level of private health insurance. You can read more about that here.

You may have to pay the Medicare levy surcharge if:

- you, your spouse and your dependent children do not have an appropriate level of private patient hospital cover; and

- you earn above a certain income.

The MLS is an amount you pay on top of the Medicare levy. If you take out an appropriate level of private patient hospital cover for yourself, your spouse and all your dependants, you will not pay the MLS.

You can view the current and past income thresholds & rates as well as some examples here: https://www.ato.gov.au/individuals-and-families/medicare-and-private-health-insurance/medicare-levy-surcharge/medicare-levy-surcharge-income-thresholds-and-rates

Lifetime Health Cover (LHC) is a government initiative that encourages you to purchase and maintain private patient hospital cover earlier in life.

If you have not taken out and maintained private patient hospital cover from the year you turn 31 and then you decide to take it out later in life, you will pay a 2% LHC loading on top of your premium for every year you are aged over 30.

For example, if you take out private patient hospital cover when you are 40 years old, you could pay an extra 20% on the cost of this cover per year for 10 years. If you wait until you are 50 years old, you could pay 40% more per year for 10 years.

The maximum LHC loading that can be applied is 70%. Once you have paid LHC loading for 10 years of continuous cover, you will no longer have to pay this loading.

If you cancel your private patient hospital cover after paying for the LHC loading for 10 continuous years, you may become liable to pay the LHC loading again if you take out another private patient hospital cover later.

You should also note that the government doesn’t pay the private health insurance rebate on the LHC loading component of a policy.

Before you can access the ATO Online Services for your business, you will need to setup access. As an individual, you can access all your personal details with the ATO via your myGov login. However, if you have a business in a different structure such as a partnership, trust or company then you first have to establish your authority to act on behalf of that entity before you can link up to ATO Online Services. This is all done using myGovID.

myGovID is different to myGov and is an app that you download to your smartphone. Once you create your myGovID it allows you to prove who you are so you can access a range of government online services. To help you work through this process, we’ve provided some further details below…

STEP 1 – Set up you myGovID

- Download the myGovID app, available from the App Store or Google Play.

- For more information, visit mygovid.gov.au/set-up

STEP 2: Link your myGovID to your business using RAM (if you are the principal authority)

Once you have setup your myGovID, then you you need to link up all the different entities of which you are the principal authority. A principal authority might be a trustee, a director, a public officer, a partner or an office bearer of a club or association. Essentially anyone with a legal authority to act on behalf of that entity.

You can link up these entities to your myGovID via the Relationship Authorisation Manager (or RAM).

- Log into the RAM using your myGovID

- Follow the instructions on How to link your business online here – https://info.authorisationmanager.gov.au/principal-authority

STEP 3: Log into ATO Online Services using your myGovID

Once you have linked up your business to your myGovID you will be able to log into ATO Online services for business as follows:

- Log into ATO Online Services for Business

- enter your myGovID email address and click Get code

- using your smartphone, you’ll need to log into your myGovID and enter the code on your screen

- select your business entity and click on Next

Now you can access all the details about this entity with the ATO. You can see which entity you are accessing in the top right corner and if you have multiple entities, simply click on switch ABN to move between businesses/entities.

When it comes to appointing us to act as your tax or BAS agent for another entity (other than yourself) then we need you to do a nomination to the ATO first. Only authorised contacts can add the nomination and you can find detailed instructions on the ATO website here: https://www.ato.gov.au/agentnomination.

You can also download a pdf version with the step-by-step instructions here: How to Nominate an Agent in ATO Online Services for Business

Yes, the Australian Taxation Office (ATO) requires you to keep records for any expenses you claim as a tax deduction. Generally, you must have a valid receipt or other proof of purchase that includes:

✔ The name of the supplier

✔ The amount of the expense

✔ The date of the purchase

✔ A description of the goods or services

✔ The payment method used

If you don’t have a receipt, you may still be able to claim a deduction if you have alternative evidence, such as bank statements, invoices, or logbooks (for work-related travel). However, the ATO may disallow deductions if you cannot substantiate them with proper records.

Can I pay cash?

Paying cash is not an issue, but you will need to have a receipt or tax invoice to substantiate the deduction should the ATO request one. In some cases bank statements can be used as noted above, however a cash withdrawal is unlikely to have sufficient information on the transaction itself without a written receipt or other documentation.

How long do I need to keep receipts?

You must keep records for at least five years from the date you lodge your tax return. If you claim deductions for assets like equipment or vehicles, you may need to keep records for longer to show depreciation or capital expenses.

Section 3 - Your Company & ASIC

When you appoint Wingr as your Registered Agent, it allows us to act on your behalf with the Australian Securities & Investments Commission (or ASIC). Once appointed, we become the first point of contact with ASIC for anything to do with your company and can view information about your company and update details as needed.

You don’t need to have a registered agent – an officeholder can register to access details by logging into the ASIC officeholder portal.

If you need to update your company’s details (e.g. your officeholder details), you can use ASIC’s online services. If you haven’t already got access to ASIC Online Services as an officeholder, you can register online.

To log into ASIC Officeholder Portal –

You can login via this link – https://www.edge.asic.gov.au/004/compportal/get/ServicesLogin. You will need:

- your ACN,

- your username, and

- your password

To register for online access

You can register for access if you are an officeholder (director or secretary) using this link – https://www.edge.asic.gov.au/cgi-bin/Lodgement/RC99V004/start/ApplicationLogin. To setup access, you will need:

- your company’s corporate key*

- your ACN

- your details (as they appear on the company establishment documents)

* your corporate key can be found on the top right corner of your most recent annual statement. You also receive a copy of the corporate key when you first establish your company, but if you can’t find it, you can also request another copy online.

You can find your corporate key in a couple of ways –

- Your corporate key will be sent to you when your company is first established. A letter is sent to your registered office from ASIC within 2 days of your company registration.

- It can also be found on the top right corner of your most recent annual statement.

If you can’t find your corporate key, you can apply online with ASIC for anew one, which will be mailed to your registered office address. You can request this online here – https://www.edge.asic.gov.au/cgi-bin/Lodgement/RC98V001/start/FormSetup. Only a company officeholder, registered agent, liquidator or external administrator can request a new corporate key.

What is the Annual Review?

Every year, ASIC will send your company an Annual Review Package – usually on the anniversary date of your initial company registration. The key purpose of the annual review is to:

- ensure all your company details are up to date;

- pay your annual fee to keep the company registered; and

- confirm that your company is solvent.

What do I do when I receive the annual review package?

To keep your company compliant with ASIC, you need to make sure you do the following:-

- Carefully check your company statement – including officeholder details, shareholder details and company addresses. If you do need to make any changes this needs to be done within 28 days of the issue date of your annual review statement to avoid additional fees. Changes are made online either by your registered agent or you can log into the ASIC officeholder portal. See FAQ – Login or Register for ASIC Online Services as an officeholder

- Pay the invoice amount – the ASIC invoice is included in the Annual Review Package documents and needs to be paid by the due date to avoid late fees. The late fees are currently

- $96 if paid one month late,

- $401 if paid more than one month late. These late fees are applied on top of the original annual fee and ASIC does not waive late fees unless there are very exceptional circumstances. See FAQ Can I waive late fees with ASIC for more details.

- Make a solvency resolution – part of the annual review process includes assessing the financial health of your company. If you believe the company to be solvent, the directors should sign a positive solvency resolution and keep a copy for your records. In order to be considered solvent, you must review the financial records of the company and determine whether you believe the company has enough cash and/or will receive enough income to cover all it’s debts and expenses for at least the next 12 months. If you do not believe the company will continue to be solvent, you should seek advice from your registered agent or accountant as there are additional steps to take with ASIC in this situation. You will find a link below to a template you can use for the positive solvency resolution if you wish. The solvency resolution needs to be passed by a majority of directors within two months of the review date.

Unfortunately, ASIC is very strict with their payment deadlines and will rarely waive late fees, except in very specific circumstances. They will usually only consider waiving a fee where there are genuine issues preventing on time payment, such as…

- Delays caused by issues with ASIC;

- court caused delays;

- records have been damaged by fire, floor or other natural disaster; or

- a natural disaster prevented you from accessing records in your home or business.

They will not waive fees where there was a failure to lodge on time, where you did not receive your annual statement or you didn’t have funds to pay.

You can apply for a fee waiver if you believe you meet the criteria. This can be completed online here.

To appoint Wingr to act as you Registered Agent with ASIC, you just need to fill out this online Form 362 Nominate or Cease a Registered Agent.

It is possible to transfer a business name from one ABN to another. This might be needed if you are changing business structures or if you sold your business and the name is part of the transfer. There are two sides to this process as follows:

If you currently own the business name and want to transfer to another ABN, you will need to follow these steps…

-

Step 1: Check Eligibility for Transfer

Before transferring a business name, ensure:

- The business name is currently registered.

- The business name is not expired. If it has expired, you’ll need to renew it before transferring.

- The business name owner (seller) is authorized to make the transfer.

Step 2: Request an ASIC Business Name Transfer Number

The current owner (seller) must:

- Log in to ASIC Connect

- Visit the ASIC Connect website and log in to your account.

- If you don’t have an account, you’ll need to create one.

- Request a Transfer Number

- Select ‘Lodge a transaction’ > ‘Cancel/Transfer Business Name’.

- Choose ‘Transfer Business Name’ and follow the prompts.

- ASIC will provide a business name transfer number (valid for 4 months).

- Provide the Transfer Number to the New Owner

- The seller must give this transfer number to the buyer.

- Do not cancel the business name registration—the new owner will complete the transfer process.

Step 3: Buyer Registers the Business Name

The new owner (buyer) must:

- Log in to ASIC Connect

- Go to ASIC Connect and log in.

- Start a Business Name Registration

- Click ‘Register a Business Name’.

- Enter the business name transfer number received from the seller.

- Complete the application by providing:

- ABN (Australian Business Number)

- Business name details

- Business address

- Contact details

- Pay the Registration Fee

- ASIC charges:

- $42 for 1 year

- $98 for 3 years

- Payments can be made by credit card, BPAY, or EFT.

- ASIC charges:

Step 4: Wait for ASIC Approval

- ASIC typically processes applications within 2–3 business days.

- You’ll receive a confirmation email once the transfer is approved.

Step 5: Update Business Records

After the transfer is complete:

- The previous owner should remove the business name from their records.

- The new owner should update details with:

- ATO (for tax purposes)

- ABN details (via the Australian Business Register)

- Banks, suppliers, and clients

Important Notes

- The transfer number expires after 4 months if not used.

- If the business has outstanding fees, debts, or compliance issues, ASIC may reject the transfer.

- The new owner should check that the business name is not trademarked separately through IP Australia.

Section 4 - Bills & Payments

STEP 1:

- sign into my.gov.au

- select ‘Australian Tax Office’

STEP 2:

- click on ‘Tax’

- select ‘Payments’

- select ‘Payment’

STEP 3:

- click on ‘Credit/Debit card’ or

- select ‘BPAY’

Depending on which option you choose, further payment details will appear.

STEP 1:

- sign into onlineservices.ato.gov.au/business/

- click ‘Login’

- sign in using your myGovID

- click on your business/entity name

STEP 2:

- click on ‘Accounts and Payments’

- select ‘Payments’

STEP 3:

- click on ‘Credit/Debit card’ or

- select ‘BPAY’ or

- select ‘Other payment methods’

Depending on which option you choose, further payment details will appear.

The ATO may impose “Failure to Lodge” (FTL) penalties if you’re supposed to lodge a return but don’t do it by the due date. This can apply to a whole range of lodgements such as activity statements, tax returns, PAYG Withholding returns, TPAR and more.

When cashflow is tight, we often find business owners avoid lodging their return so they don’t end up with a bill. But it’s important to remember that if you owe money to the ATO and lodge after the due date, they will usually apply the interest penalties from the original due date anyway – not the date of lodgement. So, even if you can’t pay by the due date, we still recommend you lodge on time to at least avoid the FTL penalties.

If you don’t pay the full amount owing on your BAS by the due date, the ATO will charge you interest on any unpaid amounts. This can add up pretty quickly and you end up losing more money out of your pocket than necessary.

Planning ahead and putting money aside is going to be the best way to ensure you can make the payments on time. This means routinely putting a portion of your income aside to cover the GST (this is often a rough estimate of say 5-7% of your income), as well as putting aside any PAYG Withholding amounts being processed via payroll.

If you’ve received a notice from the ATO that you are now registered for PAYG Instalments, you might be wondering what that means.

Firstly, it’s good to note that PAYG Instalments are not an extra tax that you have to pay. Think of it like a pre-payment of tax to help you avoid a giant tax bill when you lodge your return at the end of the year. It’s kind of like paying off your new mobile phone in monthly instalments rather than having a big financial hit all at one.

Why have you been registered? Usually you will be registered for PAYG Instalments after you lodge a tax return that resulted in a tax bill. Essentially, the ATO wants you to avoid having a similar situation again this year so they’ll ask you to start paying some of the income tax in advance so it’s not such a big chunk all at once.

How much do you have to pay? The ATO will tell you how much the instalment is, which is usually an estimate based on how much tax you paid on the last tax return. If your situation is different this year and you’re not earning as much then you can vary the instalment to make it lower. Just make sure you don’t vary your instalment down and then end up having a tax bill….the ATO will think you were just trying to avoid paying tax and can penalise you.

How do you pay? If you’re already registered for GST, you’ll pay the instalment on your quarterly Business Activity Statement (BAS). It will be an additional section on the BAS. If you’re not already lodging a BAS, then you will be issued an Instalment Activity Statement (IAS) to pay the instalment each quarter.

What are the benefits? We like to think of PAYG Instalments as a good thing for you and your business because…

- you can avoid big tax bills at the end of the year,

- you can better manage your cashflow with predictable, regular payments,

- if you overpay you get a refund with your tax return,

- you can basically put your tax payments on auto-pilot and not have to stress all year about what you might owe at the end of the year.

If you are lodging a tax return as an individual or trust, the due date of any income tax payable will vary depending on:

- the original due date of your return, and

- the lodgement date of your return.

You can check the lodgement due date of your return via ATO Online Services. Then, depending on when you actually lodge will determine the deadline for payment.

Click on the link below for a detailed outline of the deadlines for your individual situation.

If you are lodging a tax return for a company or SMSF, the due date of any income tax payable will vary depending on

- your original lodgement due date; and

- whether you lodge your return by the due date.

The due date for your lodgement will be available via ATO Online Services and will be determined by the following factors:

- whether you have outstanding tax returns for prior years @ 30 June;

- your past years’ taxable income;

- the size of your entity; and

- whether you lodge with a tax agent;

Click on the link below for a detailed outline of the deadlines for each situation.

Unfortunately, ASIC is very strict with their payment deadlines and will rarely waive late fees, except in very specific circumstances. They will usually only consider waiving a fee where there are genuine issues preventing on time payment, such as…

- Delays caused by issues with ASIC;

- court caused delays;

- records have been damaged by fire, floor or other natural disaster; or

- a natural disaster prevented you from accessing records in your home or business.

They will not waive fees where there was a failure to lodge on time, where you did not receive your annual statement or you didn’t have funds to pay.

You can apply for a fee waiver if you believe you meet the criteria. This can be completed online here.

Section 5 - Goods & Services Tax (GST)

Business Activity Statements can be lodged annually, quarterly or monthly depending on your business’ turnover.

- Annually – if your business’ GST turnover is less than $75,000 a year and you are voluntarily registered for GST, then you can opt to lodge your BAS annually.

- Quarterly – if your business’ GST turnover is over $75,000 but less than $20 million a year, then you will report quarterly.

- Monthly – if your business’ GST turnover is over $20 million a year, or the ATO has advised you must report monthly.

As a general rule, all business owners to register for GST when their annual turnover reaches $75,000 (unless you are in the rideshare industry, where you must register straight away).

However, this doesn’t mean waiting until you actually reach the $75,000 turnover. You must register as soon as it becomes clear that you WILL achieve a turnover of $75,000 within the financial year.

We suggest that when you’re monthly income consistently hits over $6,250 per month you should register for GST.

There are a few ways you can update your GST registration as follows:

- Via Online Services for Business

- Via Phone – by calling the ATO on 13 28 66

- Via your registered Tax Agent or BAS Agent (ask Wingr for help with this one)

If you meet the criteria and are required to be registered for GST and you don’t register, the ATO can impose penalties including:

- backdating the registration to the date you should have registered – this could mean having to pay GST on all sales back to this date (even if you didn’t specifically add GST to those sales amounts);

- failure to lodge penalties for the late lodgement of activities statements;

- interest charges on payments that are late as a result of the late registration.

You will be required to lodge a Business Activity Statement to report the GST you have collected and paid. This can be lodged annually, quarterly or monthly depending on your business’ turnover.

- Annually – if your business’ GST turnover is less than $75,000 a year and you are voluntarily registered for GST, then you can opt to lodge your BAS annually.

- Quarterly – if your business’ GST turnover is over $75,000 but less than $20 million a year, then you will report quarterly.

- Monthly – if your business’ GST turnover is over $20 million a year, or the ATO has advised you must report monthly.

There are a range of things that might be reported on your Business Activity Statement, including:

- GST – this includes GST you have collected as well as GST you have paid;

- PAYG Withholding – this is tax you have withheld from your employees or contractors or amounts withheld from suppliers who don’t provide their ABN;

- PAYG Instalments – this is a regular pre-payment of income tax and the ATO will let you know when you need to start making these payments;

- Fringe Benefits Tax instalments – this is for businesses who are registered and provide fringe benefits to their employees;

- Luxury Car Tax – this is limited to businesses that sell or import luxury cars or individuals that import luxury cars;

- Wine Equalisation Tax – this is limited to businesses that make or import wine or sell it wholesale.

You should check your Tax Registrations if you’re not sure what you need to report.

If you don’t pay the full amount owing on your BAS by the due date, the ATO will charge you interest on any unpaid amounts. This can add up pretty quickly and you end up losing more money out of your pocket than necessary.

Planning ahead and putting money aside is going to be the best way to ensure you can make the payments on time. This means routinely putting a portion of your income aside to cover the GST (this is often a rough estimate of say 5-7% of your income), as well as putting aside any PAYG Withholding amounts being processed via payroll.

The main difference between these two types of accounting is the timing of when we recognise the income and expenses.

Cash Accounting

Reporting on a cash basis is like looking in your bank account and only taking into account what you have already spent and received.

When You Record transactions: you record income when you actually receive the cash and expenses when you actually pay them.

Who should use this system: it’s a nice simple system, ideal for small businesses and those who want a straightforward way to see their cash flow.

Tax Implications: When you report on a cash basis, you only pay tax based on the actual cash you’ve received and can claim a deduction for the expenses you’ve actually paid for during the financial year.

Accrual Accounting

Reporting on an accrual basis is like looking at your bank account as well as all the invoices you’ve issued and all the bills you’ve received. It doesn’t matter if you have actually received or paid out the money yet.

When You Record: you record income when you issue the invoice (even if you haven’t received the payment yet) and expenses when you receive the bill (even if you haven’t paid it yet). The key dates will be the date you issue your invoices and the issue dates on the bills you receive.

Best For: Complex businesses that need a more accurate picture of their financial health, especially those with inventories or that provide credit to customers. It not only shows what you have already received and paid, but what you expect to receive and pay.

Tax Implications: When you report on an accrual basis, the tax is based on all the income you’ve invoiced and expenses you have been billed for. This may mean that you pay tax on income you haven’t yet received but can claim a deduction on expenses you haven’t yet paid – it all comes down to the date it is invoiced or billed.

Why It Matters

Cash Accounting can be easier to manage and great for keeping track of actual cash flow. Accrual Accounting provides a clearer picture of long-term profitability and financial health.

Choosing the right method depends on your business size, complexity, and financial needs.

Every time you sign a business activity statement or tax return you will receive a follow up email thanking you for signing. This email also includes a link to download a copy of the document for your records. We recommend you download a copy of all your lodgements as you go, so you’ve got them when you need them. However, these links generally do not expire so if you need to find copies of old documents that you don’t have (eg for applying for a loan), simply search your inbox and click on the links to download.

**If you’re having trouble finding it in your inbox, try searching for “LodgeIt” or “has been successfully signed” to narrow it down.

Instructions for Download

- Open the email and click on “Download Document”

- Tick the box to confirm “I’m not a robot”

- Check the last 2 digits displayed match your mobile number, and click “Send Code”

- Enter the code into the box and click on “Verify”

- Click on “Download”

Section 6 - Tax & Lodgements

If you are a sole trader or individual, you can find details of your past lodgements with the ATO by logging into myGov…

STEP 1:

- sign into my.gov.au

- select ‘Australian Tax Office’

STEP 2:

- click on ‘Tax’

- select ‘Lodgments’

- depending on what you are looking for, select ‘Activity Statements’ or ‘Income Tax’ or a range of other lodgement types.

STEP 3:

- click on the ‘History’ tab for lodged returns.

To find copies of your past business lodgements with the ATO, you will need to log into ATO Online Services for Business using your myGovID as follows…

STEP 1:

- sign into onlineservices.ato.gov.au/business/

- click ‘Login’

- sign in using your myGovID

- click on your business/entity name

STEP 2:

- click on ‘Lodgments’

- depending on what you are looking for, select ‘Activity Statements’ or ‘Income Tax’ or other lodgements as required

STEP 2:

- click on the ‘History’ tab for lodged returns

The ATO may impose “Failure to Lodge” (FTL) penalties if you’re supposed to lodge a return but don’t do it by the due date. This can apply to a whole range of lodgements such as activity statements, tax returns, PAYG Withholding returns, TPAR and more.

When cashflow is tight, we often find business owners avoid lodging their return so they don’t end up with a bill. But it’s important to remember that if you owe money to the ATO and lodge after the due date, they will usually apply the interest penalties from the original due date anyway – not the date of lodgement. So, even if you can’t pay by the due date, we still recommend you lodge on time to at least avoid the FTL penalties.

Business Activity Statements can be lodged annually, quarterly or monthly depending on your business’ turnover.

- Annually – if your business’ GST turnover is less than $75,000 a year and you are voluntarily registered for GST, then you can opt to lodge your BAS annually.

- Quarterly – if your business’ GST turnover is over $75,000 but less than $20 million a year, then you will report quarterly.

- Monthly – if your business’ GST turnover is over $20 million a year, or the ATO has advised you must report monthly.

There are a range of things that might be reported on your Business Activity Statement, including:

- GST – this includes GST you have collected as well as GST you have paid;

- PAYG Withholding – this is tax you have withheld from your employees or contractors or amounts withheld from suppliers who don’t provide their ABN;

- PAYG Instalments – this is a regular pre-payment of income tax and the ATO will let you know when you need to start making these payments;

- Fringe Benefits Tax instalments – this is for businesses who are registered and provide fringe benefits to their employees;

- Luxury Car Tax – this is limited to businesses that sell or import luxury cars or individuals that import luxury cars;

- Wine Equalisation Tax – this is limited to businesses that make or import wine or sell it wholesale.

You should check your Tax Registrations if you’re not sure what you need to report.

If you don’t pay the full amount owing on your BAS by the due date, the ATO will charge you interest on any unpaid amounts. This can add up pretty quickly and you end up losing more money out of your pocket than necessary.

Planning ahead and putting money aside is going to be the best way to ensure you can make the payments on time. This means routinely putting a portion of your income aside to cover the GST (this is often a rough estimate of say 5-7% of your income), as well as putting aside any PAYG Withholding amounts being processed via payroll.

When you operate your business as a sole trader, any tax you have to pay on your business profits is included in your individual income tax return. The amount of tax you have to pay is always calculated on your total taxable income.

To calculate your taxable income, you will declare all your different income sources. This could include things like:

- wages or salary from your job,

- investment income,

- dividends on shares,

- rental property income or

- business income

Then you can add in any eligible (ie reasonable and verifiable) deductions, which could include things like:

- travel,

- interest on loans,

- business expenses,

- motor vehicle costs,

- education etc.

All those eligible deductions are then used to reduce your income.

Taxable income = Total income less eligible deductions

Depending on what your taxable income amount is, the ATO will use the individual income tax rates to calculate how much tax you need to pay.

*Note, the types of income and deductions mentioned above are examples only. There are a large range of different types of income and deductions that will apply to different individuals depending on their circumstances.

The ATO determines the due date for your tax return based on a number of factors, including:

- are you completing your own tax return;

- have you appointed a tax agent to complete your return prior to 31 October;

- did you lodge your previous years’ tax returns on time;

- are you a larger organisation that owed tax in the previous year;

- what type of entity is lodging (company, trust, partnership etc);

You can log into the ATO online services to see what lodgements you have outstanding and what the lodgement due date is. Keep in mind, the very latest you can lodge most returns is 15th May (so 10-11 months after the end of the financial year) but you must do this through a Tax Agent.

When do I have to pay my tax?

The due date for the payment of your tax can vary so the best way to know for sure is to log into the ATO Online Services and it will show you any amounts payable as well as the due dates. To log in, see

PAYG Withholding for Employees

If you are an employee, your employer is required to deduct tax from your gross pay and pay this to the ATO on your behalf. This is called PAYG Withholding or Pay-As-You-Go Withholding.

It is taken out of your pay each pay period and is used to offset the total amount of tax you owe when you lodge your tax return. The amount of tax that your employer takes out is determined by the ATO calculators and cannot be varied unless you have an approved withholding variation in place.

PAYG Withholding for Employers

As an employer, each time you process a pay run (for yourself or for other external employees) your payroll system will tell you how much tax to withhold. This amount then gets reported and paid to the ATO on your Business Activity Statement (BAS) or Instalment Activity Statement if you’re not registered for GST.

Depending on how much PAYG Withholding you process will determine how often you need to report it and pay to the ATO – less than $25,000 a year is reported quarterly or $25,000 – $1,000,000 is reported monthly.

If you’ve received a notice from the ATO that you are now registered for PAYG Instalments, you might be wondering what that means.

Firstly, it’s good to note that PAYG Instalments are not an extra tax that you have to pay. Think of it like a pre-payment of tax to help you avoid a giant tax bill when you lodge your return at the end of the year. It’s kind of like paying off your new mobile phone in monthly instalments rather than having a big financial hit all at one.

Why have you been registered? Usually you will be registered for PAYG Instalments after you lodge a tax return that resulted in a tax bill. Essentially, the ATO wants you to avoid having a similar situation again this year so they’ll ask you to start paying some of the income tax in advance so it’s not such a big chunk all at once.

How much do you have to pay? The ATO will tell you how much the instalment is, which is usually an estimate based on how much tax you paid on the last tax return. If your situation is different this year and you’re not earning as much then you can vary the instalment to make it lower. Just make sure you don’t vary your instalment down and then end up having a tax bill….the ATO will think you were just trying to avoid paying tax and can penalise you.

How do you pay? If you’re already registered for GST, you’ll pay the instalment on your quarterly Business Activity Statement (BAS). It will be an additional section on the BAS. If you’re not already lodging a BAS, then you will be issued an Instalment Activity Statement (IAS) to pay the instalment each quarter.

What are the benefits? We like to think of PAYG Instalments as a good thing for you and your business because…

- you can avoid big tax bills at the end of the year,

- you can better manage your cashflow with predictable, regular payments,

- if you overpay you get a refund with your tax return,

- you can basically put your tax payments on auto-pilot and not have to stress all year about what you might owe at the end of the year.

The main difference between these two types of accounting is the timing of when we recognise the income and expenses.

Cash Accounting

Reporting on a cash basis is like looking in your bank account and only taking into account what you have already spent and received.

When You Record transactions: you record income when you actually receive the cash and expenses when you actually pay them.

Who should use this system: it’s a nice simple system, ideal for small businesses and those who want a straightforward way to see their cash flow.

Tax Implications: When you report on a cash basis, you only pay tax based on the actual cash you’ve received and can claim a deduction for the expenses you’ve actually paid for during the financial year.

Accrual Accounting

Reporting on an accrual basis is like looking at your bank account as well as all the invoices you’ve issued and all the bills you’ve received. It doesn’t matter if you have actually received or paid out the money yet.

When You Record: you record income when you issue the invoice (even if you haven’t received the payment yet) and expenses when you receive the bill (even if you haven’t paid it yet). The key dates will be the date you issue your invoices and the issue dates on the bills you receive.

Best For: Complex businesses that need a more accurate picture of their financial health, especially those with inventories or that provide credit to customers. It not only shows what you have already received and paid, but what you expect to receive and pay.

Tax Implications: When you report on an accrual basis, the tax is based on all the income you’ve invoiced and expenses you have been billed for. This may mean that you pay tax on income you haven’t yet received but can claim a deduction on expenses you haven’t yet paid – it all comes down to the date it is invoiced or billed.

Why It Matters

Cash Accounting can be easier to manage and great for keeping track of actual cash flow. Accrual Accounting provides a clearer picture of long-term profitability and financial health.

Choosing the right method depends on your business size, complexity, and financial needs.

There are a range of study and training support loans that fall under the category of STSL including:

- HELP – The Higher Education Loan Program (HELP) can assist eligible students with their tuition fees from a university or higher education provider. There are a range of different HELP loans including

- HECS-HELP – available to students to pay their personal contribution amount if they are enrolled in a commonwealth supported place

- FEE-HELP – is available to students to pay tuition fees when they are not enrolled in a commonwealth supported place (ie a full-fee paying place)

- STARTUP-HELP – this loan can be used to pay course fees for a Startup Year course and is paid directly to the provider by the government.

- SA-HELP – this loan can be used to pay the student and amenities fees (separate to tuition fees).

- OS-HELP – this loan can be used by student enrolled in a commonwealth supported place who want to take part in overseas study.

- VSL – The VET Student Loan (VSL) offers income contingent loan support to students studying certain diploma level (and above) vocational education and training qualifications.

- SFSS -The Student Financial Supplement Scheme (SFSS) was a voluntary loan scheme to help tertiary students cover their expenses while they studied. It is no longer available but students may still have outstanding balances to be repaid.

- SSL & ABSTUDY SSL – The Student Startup Loan (SSL) and ABSTUDY Student Startup Loan (ABSTUDY SSL) are voluntary loans available to students in higher education who receive

- Youth Allowance

- Austudy

- ABSTUDY Living Allowance

- TSL – A Trade Support Loan (TSL) provides loans for eligible Australian apprentices over a 4-year period. Upon completion of the apprenticeship a 20% discount is applied to the loan.

If you have any of the above type of loans, you need to inform your employer on your Tax File Number declaration form (or other employer documents) that you have an STSL debt. They will then withhold an additional amount from your wages to cover any potential repayment.

STSL debts are interest free loans. So unlike credit cards or other loans you don’t get charged interest on the balance every month. However, the total amount of your STSL debt is indexed every year on 1 June to maintain the balance of the loan in today’s real value.

Without going into too much detail, this simply means that in line with the rising costs of other products and services (also known as the CPI or Consumer Price Index) the real value of the loan amount also needs to increase over time. Just keep in mind that although the balance of your loan is going to increase each year, the amount you have to repay is calculated on your taxable income for the year.

As the balance increases, it will most likely mean it will take you longer to repay the loan balance so repaying more than the minimum amount will help to pay off this debt sooner and help avoid the impact of indexation.

Once you reach a certain income level, you are required to start making repayments towards your STSL debts. Each year, the ATO will publish the updated income thresholds as well as the repayment percentages so you should check their website for the current details.

Keep in mind that the repayment amount is not determined by the size of your debt, but is based on your taxable income.

If you have an STSL debt you should notify your employer via the Tax File Number (TFN) Declaration form. Your employer will then deduct an amount from your pay to help cover your STSL repayment according to the ATO withholding tables.

Keep in mind, this is not an exact science as the actual repayment amount cannot be determined until after you lodge your tax return. The amounts being withheld from your wages are not physically repaid against your STSL debt until your income tax return is lodged. It is essentially just additional tax being held by the ATO to put towards both your income tax obligations and any potential STSL repayment.

Once you lodge your tax return, the ATO will then look at your total taxable income as well as other factors to determine whether you meet the threshold to make a repayment towards your STSL debt, and if so, how much the repayment will be.

If your actual repayment amount is less than the amounts that have been withheld then you will receive a refund. If you haven’t had enough withheld from your wages then you will have to pay more to cover the repayment amount.

The Medicare Levy is an amount you pay in addition to the tax you pay on your taxable income. The current rate is 2% of your total taxable income. Generally, when your employer deducts PAYG Withholding from your wages it includes an amount to cover the Medicare levy.

Depending on your circumstances, you may be eligible for a reduction or exemption from the Medicare levy – find out more using the links below:

- Medicare levy reduction – https://www.ato.gov.au/individuals-and-families/medicare-and-private-health-insurance/medicare-levy/medicare-levy-reduction

- Medicare levy exemptions – https://www.ato.gov.au/individuals-and-families/medicare-and-private-health-insurance/medicare-levy/medicare-levy-exemption

This is different to Medicare levy surcharge, which is an additional levy that can also apply if your taxable income is above the threshold and you don’t have an appropriate level of private health insurance. You can read more about that here.

You may have to pay the Medicare levy surcharge if:

- you, your spouse and your dependent children do not have an appropriate level of private patient hospital cover; and

- you earn above a certain income.

The MLS is an amount you pay on top of the Medicare levy. If you take out an appropriate level of private patient hospital cover for yourself, your spouse and all your dependants, you will not pay the MLS.

You can view the current and past income thresholds & rates as well as some examples here: https://www.ato.gov.au/individuals-and-families/medicare-and-private-health-insurance/medicare-levy-surcharge/medicare-levy-surcharge-income-thresholds-and-rates

Lifetime Health Cover (LHC) is a government initiative that encourages you to purchase and maintain private patient hospital cover earlier in life.

If you have not taken out and maintained private patient hospital cover from the year you turn 31 and then you decide to take it out later in life, you will pay a 2% LHC loading on top of your premium for every year you are aged over 30.

For example, if you take out private patient hospital cover when you are 40 years old, you could pay an extra 20% on the cost of this cover per year for 10 years. If you wait until you are 50 years old, you could pay 40% more per year for 10 years.

The maximum LHC loading that can be applied is 70%. Once you have paid LHC loading for 10 years of continuous cover, you will no longer have to pay this loading.

If you cancel your private patient hospital cover after paying for the LHC loading for 10 continuous years, you may become liable to pay the LHC loading again if you take out another private patient hospital cover later.

You should also note that the government doesn’t pay the private health insurance rebate on the LHC loading component of a policy.

If you are lodging a tax return as an individual or trust, the due date of any income tax payable will vary depending on:

- the original due date of your return, and

- the lodgement date of your return.

You can check the lodgement due date of your return via ATO Online Services. Then, depending on when you actually lodge will determine the deadline for payment.

Click on the link below for a detailed outline of the deadlines for your individual situation.

Every time you sign a business activity statement or tax return you will receive a follow up email thanking you for signing. This email also includes a link to download a copy of the document for your records. We recommend you download a copy of all your lodgements as you go, so you’ve got them when you need them. However, these links generally do not expire so if you need to find copies of old documents that you don’t have (eg for applying for a loan), simply search your inbox and click on the links to download.

**If you’re having trouble finding it in your inbox, try searching for “LodgeIt” or “has been successfully signed” to narrow it down.

Instructions for Download

- Open the email and click on “Download Document”

- Tick the box to confirm “I’m not a robot”

- Check the last 2 digits displayed match your mobile number, and click “Send Code”

- Enter the code into the box and click on “Verify”

- Click on “Download”

Section 7 - Payroll & Superannuation

All businesses are required to pay the compulsory Super Guarantee for payments to their employees. However, depending on what type of legal structure your business operates in will determine whether you are considered an employee of your business and whether you need to pay the Super Guarantee on the money you pay yourself from the business.

- Sole Trader – If you are a sole trader you cannot be an employee of the business, so the Super Guarantee does not apply to money you take out of the business. However, you can opt to make voluntary super contributions.

- Partnership – If you are a partner of the partnership in which your business operates you cannot be an employee of the business. So again, the Super Guarantee does not apply but partners may opt to make voluntary contributions.

- Trust – If your business operates in a trust structure, the trust will have to pay the Super Guarantee on your wages if you are an employee of the business. However, if you receive distributions from the trust, these payment are treated differently and will not incur the Super Guarantee.

- Company – If your business operates in a company structure, you will have to pay the Super Guarantee on any wages you draw out if you are an employee of the business. The company will also be liable to pay the Super Guarantee on directors fees paid to you for your role as a director of the company. If you receive dividends from the company, these are not subject to the Super Guarantee payments.

Every time you pay your employees eligible wages, your payroll system will automatically calculate how much Super Guarantee you need to pay, as well as any additional voluntary payments your employees have requested. These amounts then need to be paid to your employees super funds at the end of every quarter as follows:

- Q1. July – September – due by 28th October

- Q2. October – December – due by 28th January

- Q3. January – March – due by 28th April

- Q1. April – June – due by 28th July

Keep in mind that the due date noted above is the date by which the contributions need to be deposited into your employees super accounts (unless using an approved clearing house). This means that you need to actually process and pay the contributions earlier to ensure you meet the deadline.

We recommend reporting and paying by the 18th of the month at the very latest to ensure you are on time.

The ATO will not grant any extensions for late superannuation payments, under any circumstances. This includes superannuation contributions for closely-held and arms-length employees.

If you don’t pay the contributions on time (even if it’s beyond your control) you will be required to lodge a Superannuation Guarantee Charge (SGC) statement to report any unpaid contributions or payments made after the deadline.

The ATO will also apply the following penalties (called the super guarantee charge) on late payments:

- you will have to pay super on all salary and wages (not just ordinary times earnings);

- you will incur a late/admin fee of $20 per employee per quarter;

- you will be charged nominal interested (calculated at 10% pa calculated from the 1st day of the relevant quarter)

- and, the super guarantee charge will not be tax deductible – this includes the late contributions, the admin penalty and nominal interest charge;

You should also keep in mind that the nominal interest calculated on late super payments keeps accruing up until you lodge the SGC statement – even if you have already made the late payment to the fund. If the ATO audits your superannuation payments and finds that you have made late payments that weren’t reported via the SGC Statement, you will have to lodge the SGC statement and pay penalties right up until that SGC lodgement date, not the date of the payment. This can add up to thousands of extra dollars on contributions that you have already paid.

So if there is one thing that you always, always pay on time, it should be your superannuation contributions. Our strong recommendation is to put money aside regularly to cover the contributions, automate the payments through your accounting software and make sure you always lodge and pay on time. Not only will it save you money, it will also save you a lot of time and stress.

Payday super is a new system that has been proposed to take effect from 1 July 2026 (but is not yet law). Under this system, employers will be required to pay the super contributions to the employee’s fund at the same time they pay their salary and wages.

From a cashflow perspective, this will make the payments smaller and more manageable and should avoid the stress of larger payments at the end of the quarter. Payroll software will be updated to help facilitate the change, making it a more streamlined process.

If you’re using QuickBooks, it has already updated the payroll software to support super payments at the time you lodge the pay runs, so you can start lodging more frequently whenever you wish.

Most employers will automate their super payments using their payroll software, such as Xero or QuickBooks. However, if you wish, you can use the Small Business Superannuation Clearing House (SBSCH) instead.